everything zero to low-alcohol

Industry

Little Saints impresses Shark Tank judges. (miaminewtimes.com)

Best Day Brewing raised $22.5M in 2024 to expand its non-alcoholic beer offerings and distribution, solidifying its #2 position in the market. (prnewswire.com)

Wine sales fell 8% in 2024 due to changing consumer preferences, prompting producers to focus on premium and non-alcoholic offerings for growth. (fooddive.com)

Bordeaux Families launched alcohol-free sparkling and still wines, investing €2.5M in a new facility, aiming to innovate amidst declining red wine production. (thedrinksbusiness.com)

At the Inc. 5000 Conference, Sweetgreen and Ghia founders discussed creating new market niches by offering healthier, alcohol-free options, driving major consumer shifts. (inc.com)

Low-alcohol wines are gaining traction as consumers seek moderation, with brands using innovative methods to reduce alcohol while maintaining flavor. (vintnerproject.com)

France opens its first industrial wine dealcoholization center. (vinetur.com)

The Cashmere Fund invests in De Soi. (linkedin.com)

Heineken’s Q3 2024 update shows 11% growth in non-alc beer/cider. (theheinekencompany.com)

Athletic brand ranks #53 YTD nationally; for the last four weeks has surpassed Tecate, Jack Daniel’s, and Kona, with 71% sales growth reaching $72.6 million by October 6 in Circana MULC. (linkedin.com)

Zeronimo wines are now available in Canada with Sobr Market as the first partner. (instagram.com)

Blake Lively's Betty Booze and Betty Buzz join Princess Cruises' "Love Line Premium Liquors," offering non-alc sparkling drinks and low ABV cocktails. (ft.com)

Podcast: Why brewers are betting big on alc-free beer. (reuters.com)

Podcast: Botivo’s 12 unusually lavish brand building principles that could change your life. (spotify.com)

Video: Building a bootstrapped, boozeless beverage company with Absence of Proof. (youtube.com)

Do Not Miss: Distill Ventures & Derek Brown host seminar, No & Low: Non-Alcoholic by the Numbers. (distillventures.com)

Deadline Extended to 11/15 Calling All Bartenders: The NO FUN Cocktail Competition challenges bartenders to create zero-proof cocktails, with finals at the Mindful Drinking Fest on January 10, 2025, celebrating creativity and the art of mindful drinking. (mindfuldrinkingfest.com)

Update from Fieldwork Co-Founder, Barry Braden, on last week’s post:

re: East Bay brewers like Fieldwork and Headlands are embracing non-alc beer to meet growing consumer demand, despite production challenges and modest sales. (berkeleyside.org)

Fieldwork is being wildly successful with NA beer. Our beers have only been available for less than five months and we've already sold over 150,000 units in our local market. We've expanded the availability of these beers throughout California, and to the Pacific Northwest and Colorado. We don't have production challenges and are now producing 45,000 cans with every batch. -Barry

Presented by ABV Technology

The decision to crowdfund was a natural step for us. Over the years, we’ve built a community of like-minded individuals—brewers, winemakers, beverage enthusiasts—who believe in the future of No and Low alcoholic drinks. We wanted to give that community a chance to be part of our journey in a meaningful way. Crowdfunding allows us to democratize our growth and invite everyday people, not just institutional investors, to participate in our success.

Crowdfunding also aligns with our values of transparency and inclusivity. When you invest in ABV Technology through Wefunder, you’re not just contributing capital—you’re becoming a part of the company. You’ll have access to updates, progress reports, and insights into the decisions we make. We want our investors to feel as involved as possible because, at the end of the day, we’re building this future together.

Join ABV Technology in their quest to bring better-for-you beverages to all. (Learn more @ Wefunder)

Brand Moves

Partake Brewing to be a venue sponsor for TO Live. (linkedin.com)

Everleaf and Tayēr + Elementary release a limited edition non-alcoholic Jasmine + Lily Highball RTD. (thespiritsbusiness.com)

Bero Brewing appears on billboards in Time Square in partnership with Shopify. (linkedin.com)

Two Rocks Brewing Co.'s 2.5% Pale Ale offers a vegan and gluten-free beer option (barmagazine.co.uk)

AF Drinks is taking over LA with latest campaign. (linkedin.com)

Trip Drinks and mindfulness app Calm launch new 'Canned Calm' in the U.S. (forbes.com)

De Soi teases something new. (instagram.com)

Reply to this email with your launches, collabs, expansions and/or news.

Health

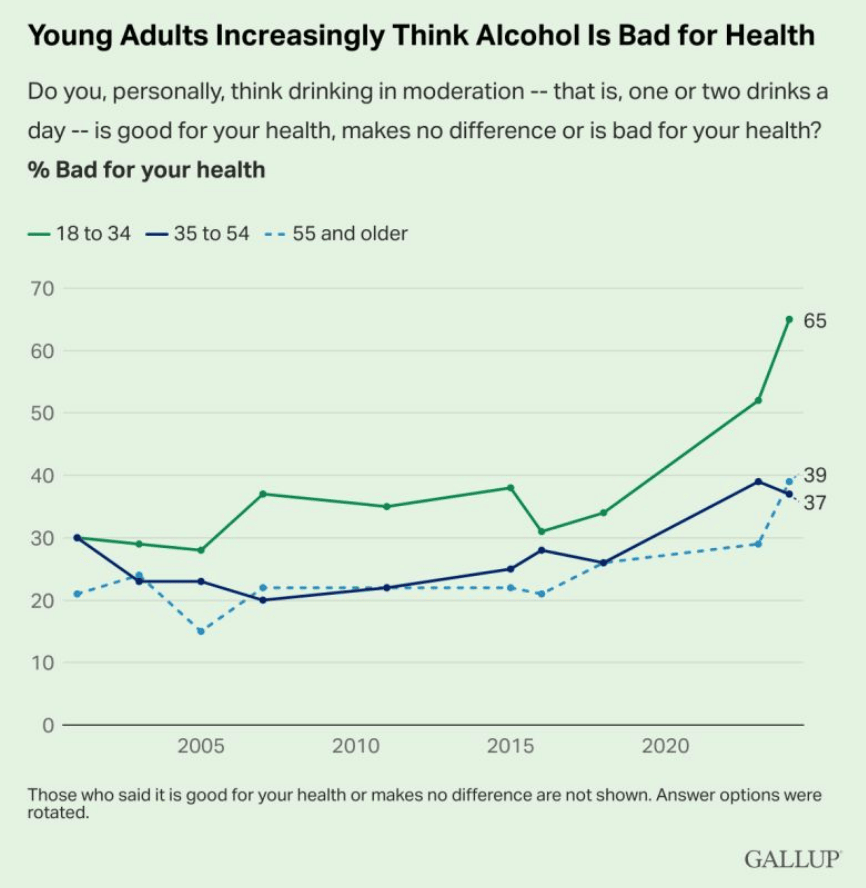

The US may revise alcohol guidelines due to increased cancer risks, emphasizing abstinence as the only safe option, effective by 2026. (medcentral.com)

Ozempic (Semaglutide) explored as a potential treatment for alcohol dependence. (npr.org)

Experts highlight alcohol's carcinogenic risks and health impacts, debunking the "health halo" myth as awareness of its dangers grows. (womenshealthmag.com)

A middle-aged woman recounts quitting binge drinking amid rising rates among women, with studies showing a 34.7% increase in alcohol-related deaths for women (2016-2021) and a near doubling of binge-drinking rates (2012-2022). (wsj.com)

Culture

Model Ashley Graham partners with Trip. (dailymail.co.uk)

Dray Drinks hosts Boston’s first non-alc beer garden, "Notoberfest," featuring NA beer, wine, and cocktails at Charles River Speedway. (boston.com)

Delaware restaurants expand their menus to include non-alc beers and drinks. (delawareonline.com)

A look at Fieldwork’s non-alc options. (usatoday.com)

Brooklyn Brewery launches 'Calling All Makers,' a new creative initiative. (brooklynbrewery.com)

Non-Non-Alc

Beer sales decline as consumers prioritize flavor over traditional styles, pushing breweries to create more versatile, flavored options beyond "beer-flavored beer." (vinepair.com)

As seasons change, Americans are favoring warming wines, with Prosecco and red Burgundy popular, while Sauvignon Blanc sales continue to grow. (thedrinksbusiness.com)

US consumers have reduced spending on spirits due to rising costs, with vodka, whisky, and tequila sales dropping, impacted by inflation, destocking, and growth in ready-to-drink beverages. (ft.com)

Data Shot 🥃

Careers in Non-Alc

Non-Alc Activity Tracker

Boost your team's insights—forward to a colleague :)